After a welcome announcement by the government the Coronavirus Job Retention Scheme(CJRS) has been extended to 31 March 2021 while the Job Support scheme has been postponed.

Businesses will be able to apply for CJRS online from Wednesday 11 November 2020 – for periods from 1 November. You will need to submit any claims for November by 14 December.

What’s new in the support available

What you need to do now

Submit any claims for periods up to 31 October on or before 30 November. Claims for periods up to 31 October will not be accepted after 30 November. Claims are subject to eligibility and the rules in force at the time. Search 'Coronavirus Job Retention Scheme' on GOV.UK for full eligibility criteria.

What you need to do for your claims – for periods from 1 November

Businesses will be able to apply for CJRS online from Wednesday 11 November 2020 – for periods from 1 November. You will need to submit any claims for November by 14 December.

What’s new in the support available

- CJRS has been extended to 31 March 2021 for all parts of the UK. From 1 November, the UK Government will pay 80% of employees’ usual wages for the hours not worked, up to a cap of £2,500 per month. This will be reviewed in January.

- You and your employees do not need to have benefited from the scheme before to claim for periods from 1 November. Go to GOV.UK for the full eligibility criteria.

- HMRC intends to publish details of employers who use the scheme for claim periods from December, and employees will be able to find out if their employer has claimed for them under the scheme.

- There are now monthly deadlines for claims. Claims for periods starting on/after 1 November must be submitted within 14 calendar days after the month they relate to, unless this falls on a weekend in which case the deadline is the next weekday. For further details go to GOV.UK and search 'Claim for wages through the Coronavirus Job Retention Scheme'.

- The Job Retention Bonus will no longer be paid in February 2021 and an alternative retention incentive will be put in place at the appropriate time.

- The launch of the Job Support Scheme has also been postponed.

What you need to do now

Submit any claims for periods up to 31 October on or before 30 November. Claims for periods up to 31 October will not be accepted after 30 November. Claims are subject to eligibility and the rules in force at the time. Search 'Coronavirus Job Retention Scheme' on GOV.UK for full eligibility criteria.

What you need to do for your claims – for periods from 1 November

- Read the new guidance – go to GOV.UK and search 'Extension to the Coronavirus Job Retention Scheme' – to check if you and your employees are eligible.

- Agree working hours with any employees you wish to furlough for November and agree any changes to their employment contract.

- Work out how much you can claim for your employees using our CJRS calculator and examples. Search for 'Calculate how much you can claim using the Coronavirus Job Retention Scheme' on GOV.UK.

- Submit any claims for periods from 1 November no later than 14 December.

Further information may be found on the HMRC website at gov.uk

Pegasus released a document to cover the processing of furloughed employees' 80% usual monthly wage costs, up to £2500 a month for the Coronavirus Job Retention Scheme. The full document dealing with Processing in Opera 3 is now available for download.

Pegasus released a document to cover the processing of furloughed employees' 80% usual monthly wage costs, up to £2500 a month for the Coronavirus Job Retention Scheme. The full document dealing with Processing in Opera 3 is now available for download.

Coronavirus Job Retention Scheme Assistance Reports – Opera 3

Pegasus has issued further guidance on the Coronavirus Job Retention Scheme and created two new reports to assist employers with calculating furloughed employees' claims. Essentially the reports show the amount that can be claimed back from HMRC for furlough pay and associated ERs NICs and ERs minimum pension contributions. A software upgrade is not required but you will need to follow these steps to install the update onto your Opera 3 system.

1. Download the Opera 3 JobRetentionScheme.zip (select the download button below) and extract the files.

2. Ensure all users are logged out of Opera and XRL (and any other products which link into your Opera system).

3. Run the ‘CopyJobRetentionSchemeReports.exe’.

4. Check the paths suggested are the correct locations for your System and Reports directories.

5. Select ‘Copy Reports’.

6. Click ‘OK’ when completed successfully and then ‘Quit’ to exit the program.

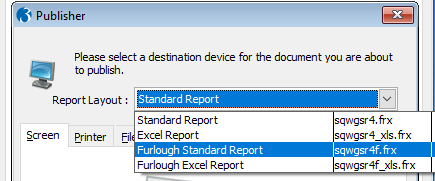

The new reports can be found in Payroll under EOY/Specials Reports > Advanced Pay/Ded List. At the point of the Publisher loading, select ‘Report Layout’ dropdown and choose the required report.

Download the Furlough Assistance Reports.pdf file below for further guidance on how to run the new reports.

Pegasus has issued further guidance on the Coronavirus Job Retention Scheme and created two new reports to assist employers with calculating furloughed employees' claims. Essentially the reports show the amount that can be claimed back from HMRC for furlough pay and associated ERs NICs and ERs minimum pension contributions. A software upgrade is not required but you will need to follow these steps to install the update onto your Opera 3 system.

1. Download the Opera 3 JobRetentionScheme.zip (select the download button below) and extract the files.

2. Ensure all users are logged out of Opera and XRL (and any other products which link into your Opera system).

3. Run the ‘CopyJobRetentionSchemeReports.exe’.

4. Check the paths suggested are the correct locations for your System and Reports directories.

5. Select ‘Copy Reports’.

6. Click ‘OK’ when completed successfully and then ‘Quit’ to exit the program.

The new reports can be found in Payroll under EOY/Specials Reports > Advanced Pay/Ded List. At the point of the Publisher loading, select ‘Report Layout’ dropdown and choose the required report.

Download the Furlough Assistance Reports.pdf file below for further guidance on how to run the new reports.

Employers can make a claim through the Job Retention Scheme if they have put their employees on temporary leave (furlough) because of the coronavirus (COVID-19) outbreak. HMRC released a Coronavirus Job retention Scheme Calculator to help with calculating the claim for furloughed workers.

NB: You will need to calculate the amount you are going to be claiming by using the calculator to work it out. Your payroll system is not designed to manage claiming back wages from HMRC and therefore the calculation of furloughed employees and the claimback is your business' responsibility. Please follow Pegasus guidelines to record the payment in your Opera 3 Payroll & HR system and follow the HMRC guidelines to claim the 80% of furloughed employees wages back. Your payroll system will not manage this process. To claim use the link below. HMRC will retain the right to retrospectively audit all aspects of your claim.

What you’ll need to make a claim

- to be registered for PAYE online

- your UK bank account number and sort code

- your employer PAYE scheme reference number

- the number of employees being furloughed, their NI numbers and employee payroll numbers

- the start date and end date of the claim with the full amount you’re claiming for including employer NI contributions & employer minimum pension contributions

- your phone number

- contact name

Watch a video to learn more about the CJRS Extension Update published by HMRC.